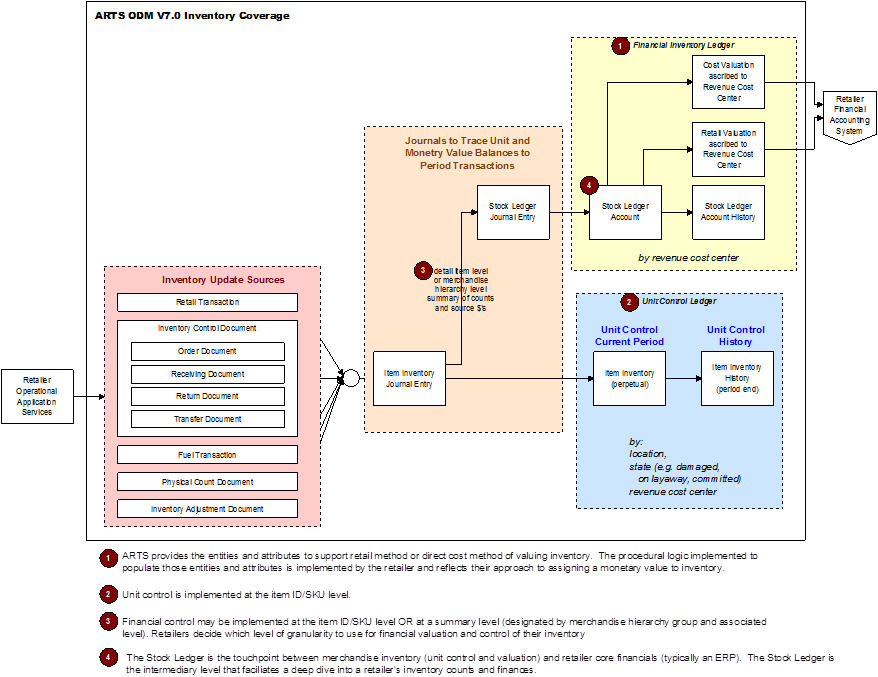

Theme Concepts Inventory stewardship contains subject areas that support monitoring and controlling inventory after it is received or transferred from another inventory location. There are two complementary inventory management views in retail inventory. The first is the tangible physical inventory made up of retail selling units, cases, pallets and other quantities of merchandise items. This is called the unit control view of inventory. The second view is the financial view of inventory. It considers the retail and cost valuation of items held in inventory. Unit control inventory is a count of some kind. Financial inventory involves applying rules to determine the retail (based on selling price) and cost monetary value of inventory. The rules are prescribed by different organizations like accounting regulatory bodies, tax authorities and retailer inventory policy. Accordingly, it is possible for a retailer to operate more than one inventory valuation regime depending on the valuation's intended use and user type. The diagram presented here shows the major business components that define the conceptual basis the ARTS ODM V7.0/7.1 inventory stewardship subject areas. Figure 70: Concepts Behind ARTS Inventory Stewardship Subject Areas

ARTS Data Model Unit Control View of InventoryIn the ARTS data model, all unit control inventory (physical quantities) is maintained on a perpetual inventory basis at the item (SKU) level. Perpetual inventory means that the on hand balance is updated immediately when items are received, sold, transferred or adjusted. Item level tracking means that all on hand counts as well as inventory movements are ascribed to individual items (SKUs). In ARTS the item-level is the most granular view of merchandise. The ARTS unit control inventory entities allow item inventory counts to be attributed to locations, inventory states, and/or revenue cost centers. It is up to the retailer to choose how these three dimensions are use to report unit control inventory. Inventory in and out counts originate as transactions and inventory control documents. The document item counts are assigned to a retailer designated location-state-revenue cost center for a reporting period through a Journal Entry. Journal entries are summarized into a current unit control period perpetual inventory. At the end of a period, the period and its cumulative values is inserted into Item Inventory History, the cumulative values cleared and the ending balance on hand count is written to a new period. The unit control aspect of inventory monitoring and control is reflected in the light blue block, "Unit Control Ledger" in the diagram. ARTS Data Model Financial View of InventoryThe financial control of inventory uses the same transaction sources (in the pink block) as the item inventory unit control. Instead of item counts, it monitors and controls the monetary value of inventory as it moves into and out of designated locations, states and revenue cost centers. Unlike the unit control view of inventory, the financial view may be maintained at a summary level in a Stock Ledger. This means that while item units are tracked by item identity (or SKU), item values may be tracked at a merchandise hierarchy level. For example a department store will track physical items at a SKU level but maintain its financial inventory at a class level. Retailers choose the appropriate detail or summary level for monitoring and controlling the financial value of their inventory. The ARTS Data Model also allows retailers to mix and match different levels of summarization for financial inventory management. Accordingly a retailer may choose to track high unit value merchandise categories at a unit level and low value commodity categories at a class or department level. ARTS provides the data structures. Retailers define the process and logic used to populate the data structures. Most retailers tailor their approach to tracking financial inventory to their merchandising strategy and category management policies.Inventory Financial ValuationThe inventory financial value period balances include cost figures and retail figures. How those figures are used to assign a value to a retailers inventory varies with the inventory accounting method used. In retail there are two primary categories of inventory accounting methods. The first is a retail method. The second is a cost method. ARTS supports both and it is up to the retailer to build the procedural code and logic to implement one or both of these inventory methods. The Stock Ledger Account (in the light yellow block) is the container for inventory valuation. While unit control maintained unit counts by inventory location, inventory state and revenue cost center, the stock ledger aggregates quantifies and monetary value into revenue cost centers. This is part of its role in refactoring a unit record view of inventory into a financial view of inventory. Two valuation components one for retail and one for cost define how a stock ledger inventory account is valued. The ARTS Data Model provides the information needed to support the retail method of accounting or the direct cost method of accounting. Retailers may implement both methods if they choose. The logic and math involved in calculating inventory value are specified and implemented by the retailer. The data model provides placeholders for the results and data elements to use as the inputs into the calculations.

|