Theme Concepts

ARTS ODM V7.3 replaces its limited gift certificate based representation of stored value instruments with a comprehensive model. It retains gift certificates and extends coverage to a wide range of prepaid offerings from retailers and third parties. This topic explains how the ARTS ODM represents stored value instruments and the business principles behind the data model.

What is a Stored Value Instrument ?

A StoredValueInstrument is a plastic card, paper document, key fob, smart phone app or other tangible or intangible token that carries a credit balance that may be used to pay for (debit) customer purchases or in tender exchanges (converting the stored value into another tender media like cash, credit/debit card credit, send check, etc.). StoredValueInstruments are used like money but are paper or digital surrogates that are typically purchased and have value added to them in exchange for "real" money. As the name suggests, these entities retain value and may be used to make purchases. Typically stored value instruments may be added to or subtracted from through retail sales and return transactions.

Stored value instrument processing includes sales, activation, authorization, balance inquiries, adjustments, cancellation, cash-out and refill operations. Because they have a real monetary value tied to them, stored value instruments whether sponsored by a retailer or a third party require some form of activation. Activation is the recording of the card or other stored value media, its initial balance and availability to be used as payment. Authorization is usually required as part of the activation process. Authorization is the verification of the validity and authenticity of the stored value instrument.

Stored value instruments may be issued and sponsored by a retailer or a third party. Retailer-branded gift cards that may only be spent in the retailer's store or web site are examples of stored value instruments "owned by" the retailer. Owned by as used here means that the retailer takes on the liability associated with the prepayment value of the gift card. A third party stored value instrument may be sold and serviced by a retailer but the third party, like VISA or AT&T (prepaid phone card), takes on the liability associated with the prepaid value on the stored value instrument.

Open Versus Closed Stored Value Instruments

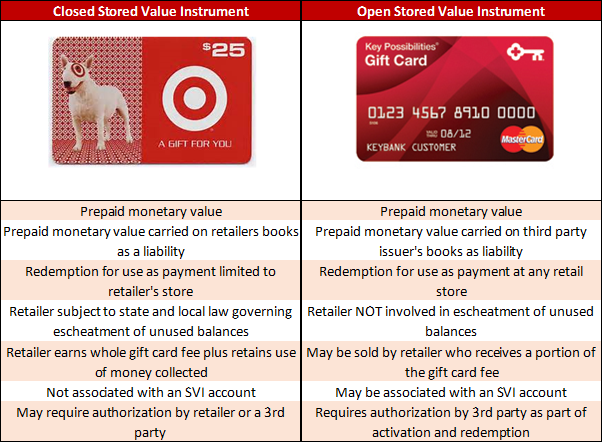

Retailers sell, activate and redeem monetary value against two broad kinds of stored value instruments as illustrated here.

Figure 80: Open Versus Closed Stored Value Instruments

Open stored value instruments are typically issued by third parties like Master Card, VISA, AMEX, etc. They are different from debit cards and credit cards because the are prepaid. They may be sold by any number of retailers, financial institution, airlines, etc. When customers buy and redeem third party stored value instruments the liability associated with it is held by that third party, not the retailer. This is important in how stored value instruments are treated for accounting purposes. Third party stored value cards are sold to customers at a markup (or fee) like $5.95 for a $100 gift card. The total amount paid in this scenario is $105.95. The stored value instrument third party issuer gets the $100.00 credit associated with the liability and the retailer books sales for $5.95.

Closed stored value instruments are typically offered by a retailer and may only be used to purchase products and services from that retailer. In this scenario the retailer assumes the liability for the sold stored value instrument. Using the previous example, the retailer will book $100 as a liability (it has collected money from the customer, but not sold them anything) and $5.95 as sales. Unlike the third party issued stored value instrument, the retailer carries a $100 liability in its balance sheet. This distinction is important because ARTS supports both retailer and third party issued stored value instruments. For retailer issued stored value instruments it is also possible to have an account tied to it. This makes it possible to maintain one or more stored value instruments that may be linked to an account (CustomerStoredValueAccount). That account could for example represent an aggregation of individual stored value cards for a household. The account adds a level of flexibility to the stored value instruments by allows monetary balances to be transferred between cards, for negative balances to be offset by positive balances in related cards, etc.

There is no retailer-maintained CustomerStoredValueAccount for third party issued stored value instruments. The ARTS ODM delegates any account maintenance to the third party which it out of scope for the retail enterprise data model. Note, however, that the activation, authorization, inquiry, SVI funds sale, SVI payment tendering actions are all still represented within the scope of a retail transaction or tender control transaction. The main difference is where debit and credit balance sheet amounts are carried.

Distinguishing Characteristics of Stored Value Instruments

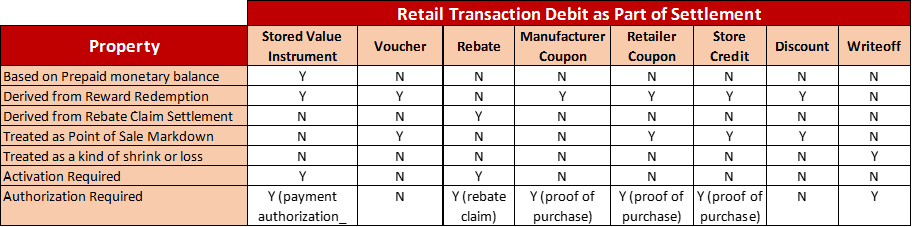

Retailers often use terms like voucher, coupon, and rebate in an informal, imprecise way which may cause confusion when attempting to represent them in a data model. Stored value instruments are sometimes issued as part of a reward offering which requires some explanation to separate them from discounts. The purpose of this part of the narrative is to dissect the concept of stored value instruments and distinguish them from other kinds of retail transaction debit line items (i.e. line items used to offset the net amount due to settle a retail transaction). The figure shown here lists the salient differences between stored value instruments and other kinds of retail payment/debit offsets used to settle a transaction.

Figure 81: Stored Value Instruments' Distinguishing Properties

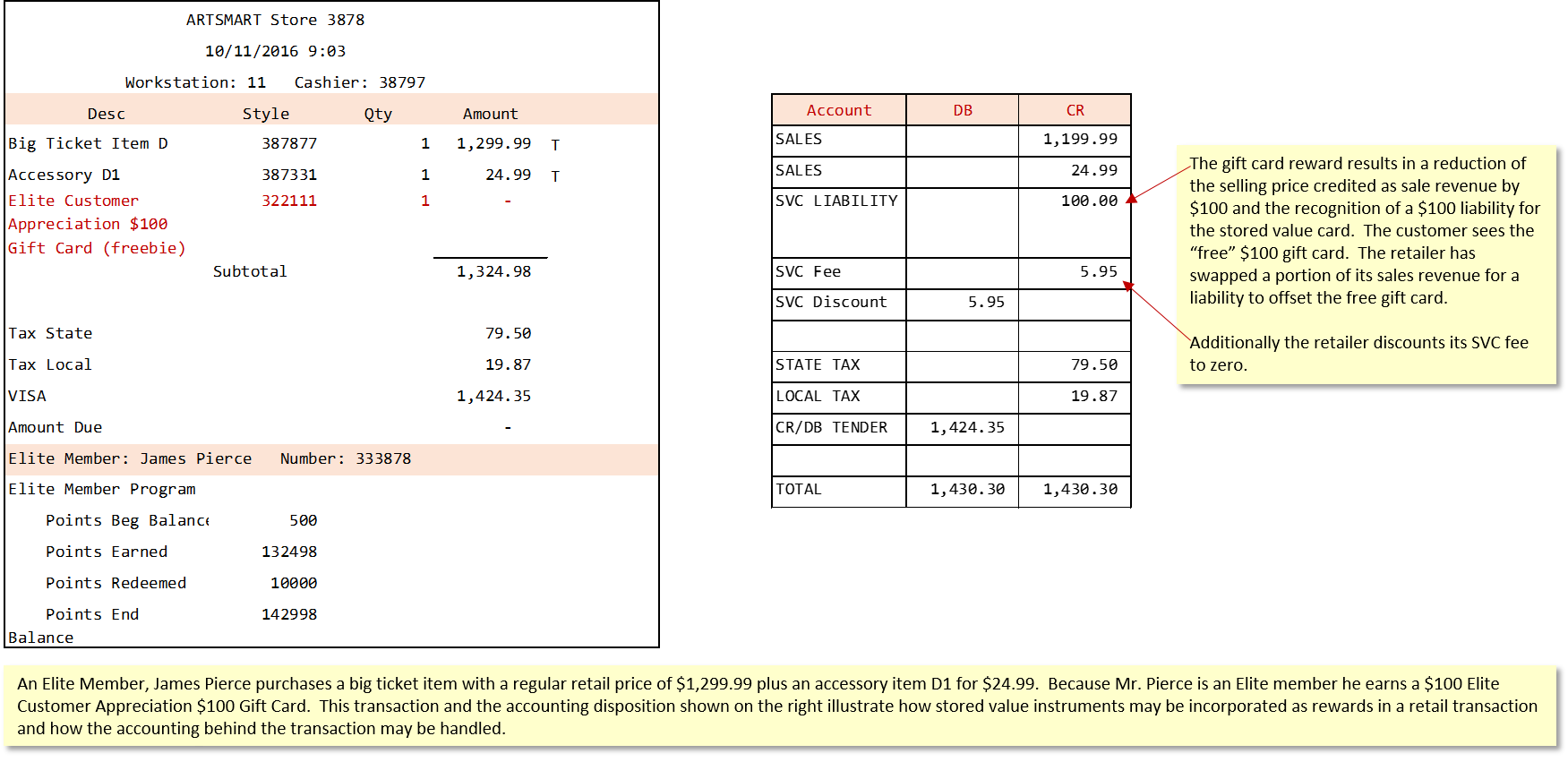

As illustrated in the figure here, a Stored Value Instrument may be used to redeemed earned rewards. In this kind of reward redemption scenario the stored value instrument treatment is different from a stored value funds sale which involves taking money from the customer. The next figure illustrates how a stored value instrument may be treated as part of a reward redemption. In this scenario

Figure 82 - Stored Value Instrument as Reward Redemption

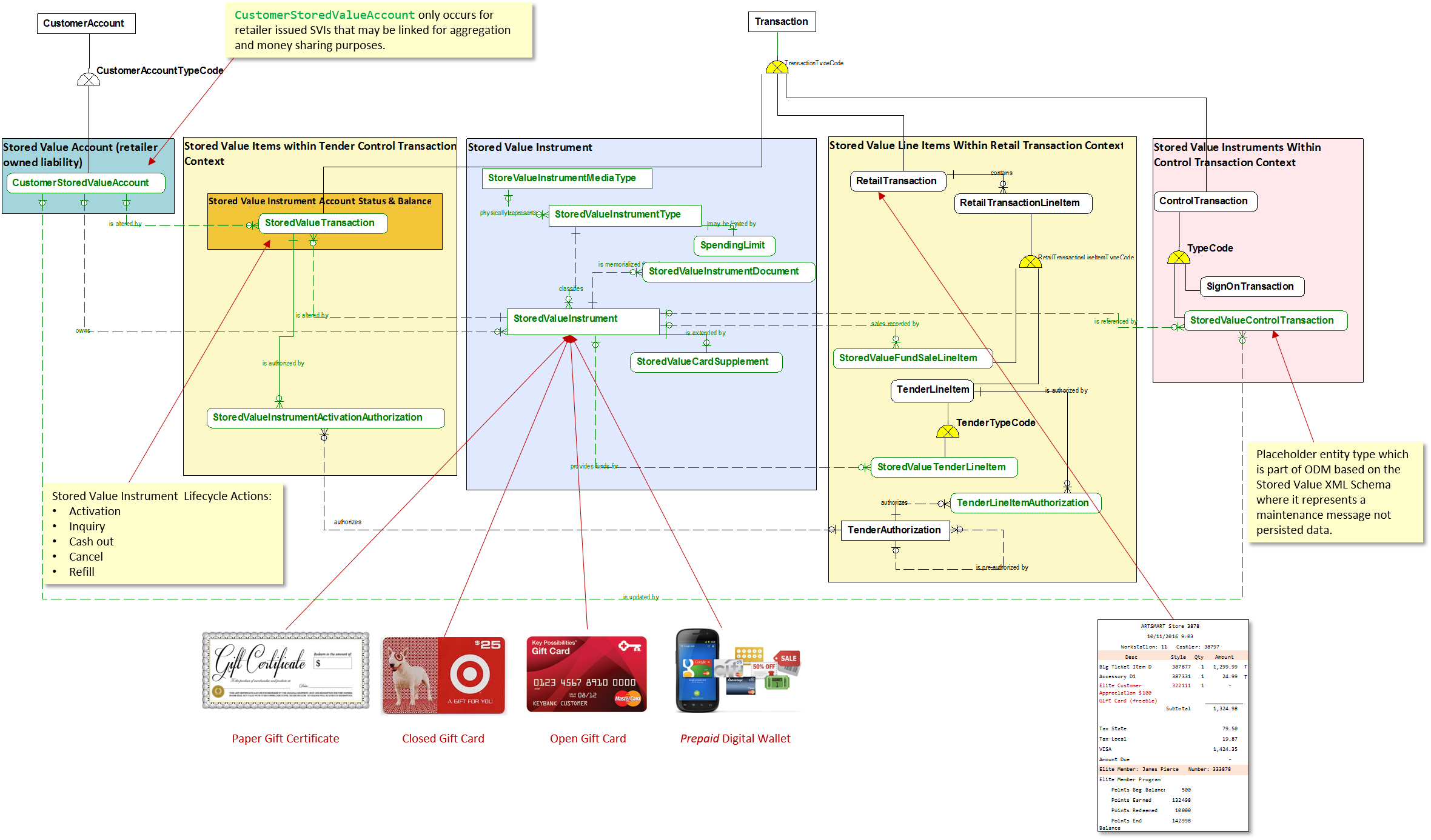

Stored Value Entities and Relationships

The entity model for stored value instruments is presented in the next diagram. The Stored Value Instrument block contains the core entities that identify and describe different kinds of stored value instruments. The Stored Value Line Items Within Retail Transaction Context block shows the relevant retail transaction entities involved in selling stored value funds and using stored value funds as a form of payment tender to settle a retail transaction.

The StoredValueTransaction entity is a subtype of Transaction. Originally it was a subtype of TenderControlTransaction. In reviewing the definition of TenderControlTransaction which emphasizes the physical control and tracking of tender throughout the store, it became clear that StoredValueTransaction is fundamentally different and should be treated as a subtype of Transaction. As illustrated in the entity overview, the StoredValueTransaction captures stored value instrument activation, inquiry, cash out, refill and cancellation which may occur outside the scope of a RetailTransaction.

A StoredValueInstrument may be sold as a StoredValueFundSaleLineItem (as a type of RetailTransactionLineItem) and used as a form of payment as a StoredValueTenderLineItem (as a subtype of TenderLineItem) within the scope of a RetailTransaction.

The Stored Value Account block's CustomerStoredValueAccount entity, as discussed earlier is used to aggregate fund balances and reporting for one or more retailer issued stored value instruments.

The StoredValueControlTransaction entity shown in the pink block (Stored Value Instruments Within Control Context) is a placeholder for now. It reflects the Stored Value Instrument message built into the Stored Value XML schema. As noted, that schema represents maintenance message data, not persisted data (which is the kind of data represented in the ODM).

Figure 83 - Stored Value Subject Area Entity Overview