Subject Area Concepts This subject area includes the entities that make up a retail transaction in the ARTS ODM V7.0/7.1. The retail transaction is by far the most complex and most frequently occurring type of transaction. The retail transaction captures the sale or return of retailer merchandise and services along with the tax liabilities and customer payment. A retail transaction represents the point in a customer-retailer interaction when items are exchanged for tender and sales revenue is recognized. The Retail Transaction View organizes and defines the data structures required to support the recording of sales and returns and related business between the store and its customers. RetailTransaction records are created at the point where the store's merchandise and services are transformed into tender and credited as sales (or the reverse for returns). The retail transaction views answer questions like:

There are certain design principles the ARTS Operational Data Model incorporates into the Retail Transaction Views to emphasize fiscal and unit accounting integrity. These principles are:

❖Transaction level: information to describe the people, place, time, location and type of business conducted between the store and a party; ❖Line level: information to describe the individual items that make up the transaction; and ❖Line modifier level: information to apply specific pricing rules, sales tax rules, sales restriction rules, and so on to individual line items in a transaction.

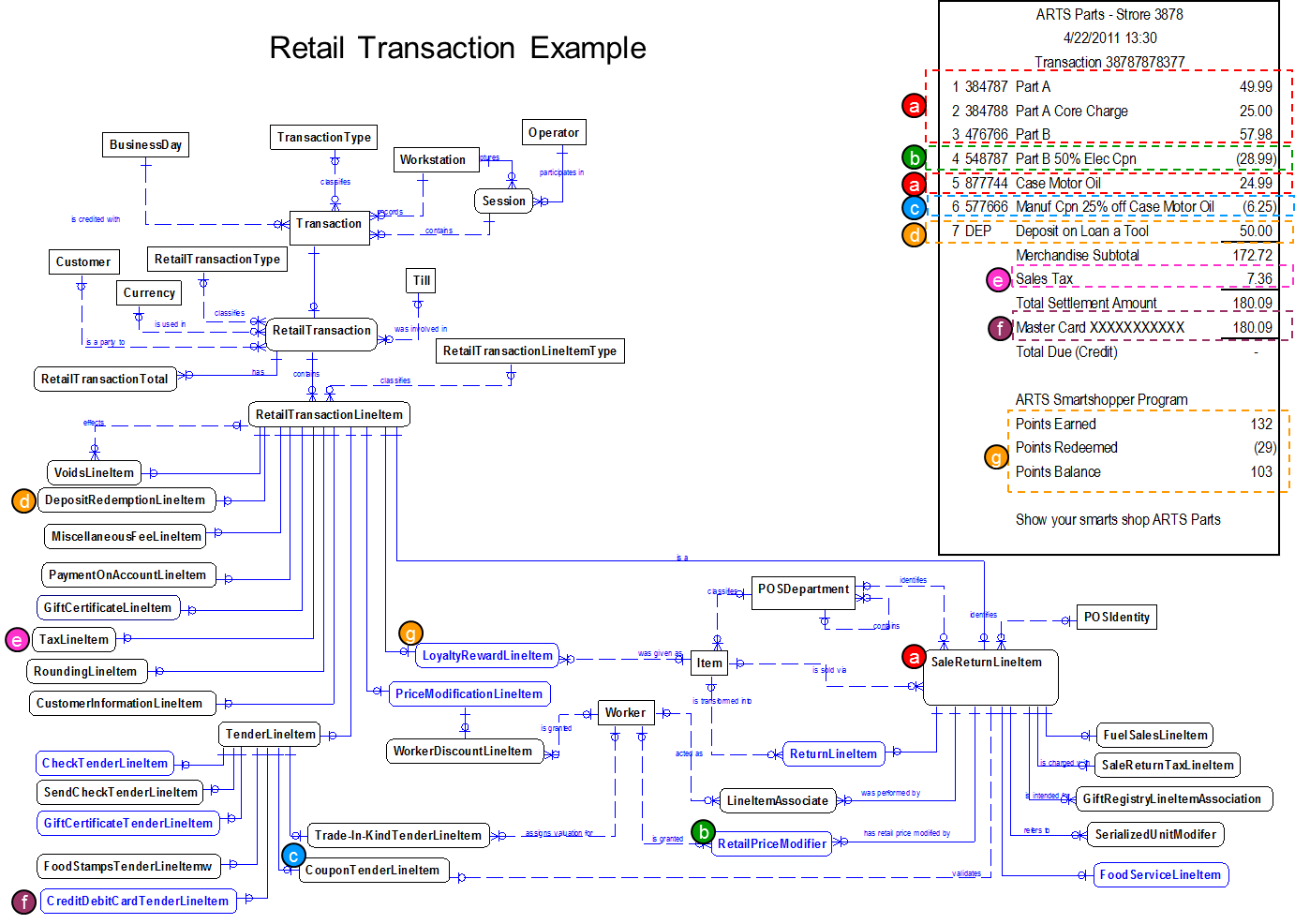

The Logical 02300 – Retail Transaction Macro Diagram view presents a high-level context for exploring how the ARTS Operational Data Model represents transactions. Retail transactions have to handle a complicated combination of business activities that include identifying merchandise and services, calculating the retail price, calculating taxes, and collecting and verifying tender, collecting customer information including loyalty program parameters and settlement. Given the complexity of business activity, the ARTS Operational Data Model breaks retail transactions into a number of subsidiary views. The diagram shown here associates an ARTS retail transaction entity model with a simulated sales receipt. It highlights the way sale/return line items, price modifiers, tax and tender shown on a sales receipt are rendered in the third normal form ARTS Data Model. The colored letters on the sales receipt match the colored letters on the entity model. Figure 54 - Concrete Retail Transaction Example

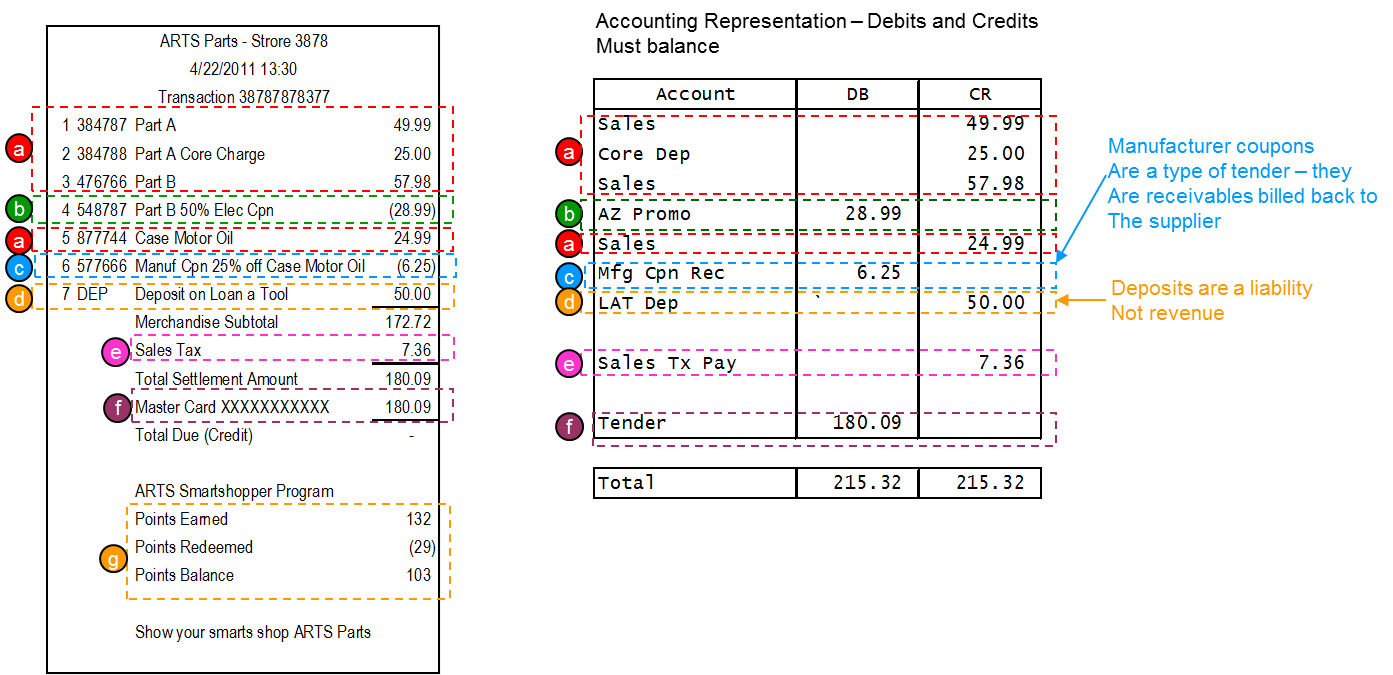

This is a typical retail transaction. There are many retail transaction variants and some can get very complex. In ARTS all retail transaction debits and credits must balance to zero. The next diagram shows how the sales receipt is recast into an accounting model with line item-level debit and credit dispositions. Figure 55 - Retail Transaction Accounting Disposition

T |